Analyzing the intersection of consumer spending and financial plumbing

WHAT WE DO:

• Analyze all manner of consumer companies, including their historical volume and price trends

• Analyze bank lending (and deposit) data and how it affects the aforementioned consumer companies

• Analyze Fed/central bank data given their importance to the banking system and economy

• Analyze broker-dealer data given their importance as intermediaries in the Treasury market

FEATURED RESEARCH

-

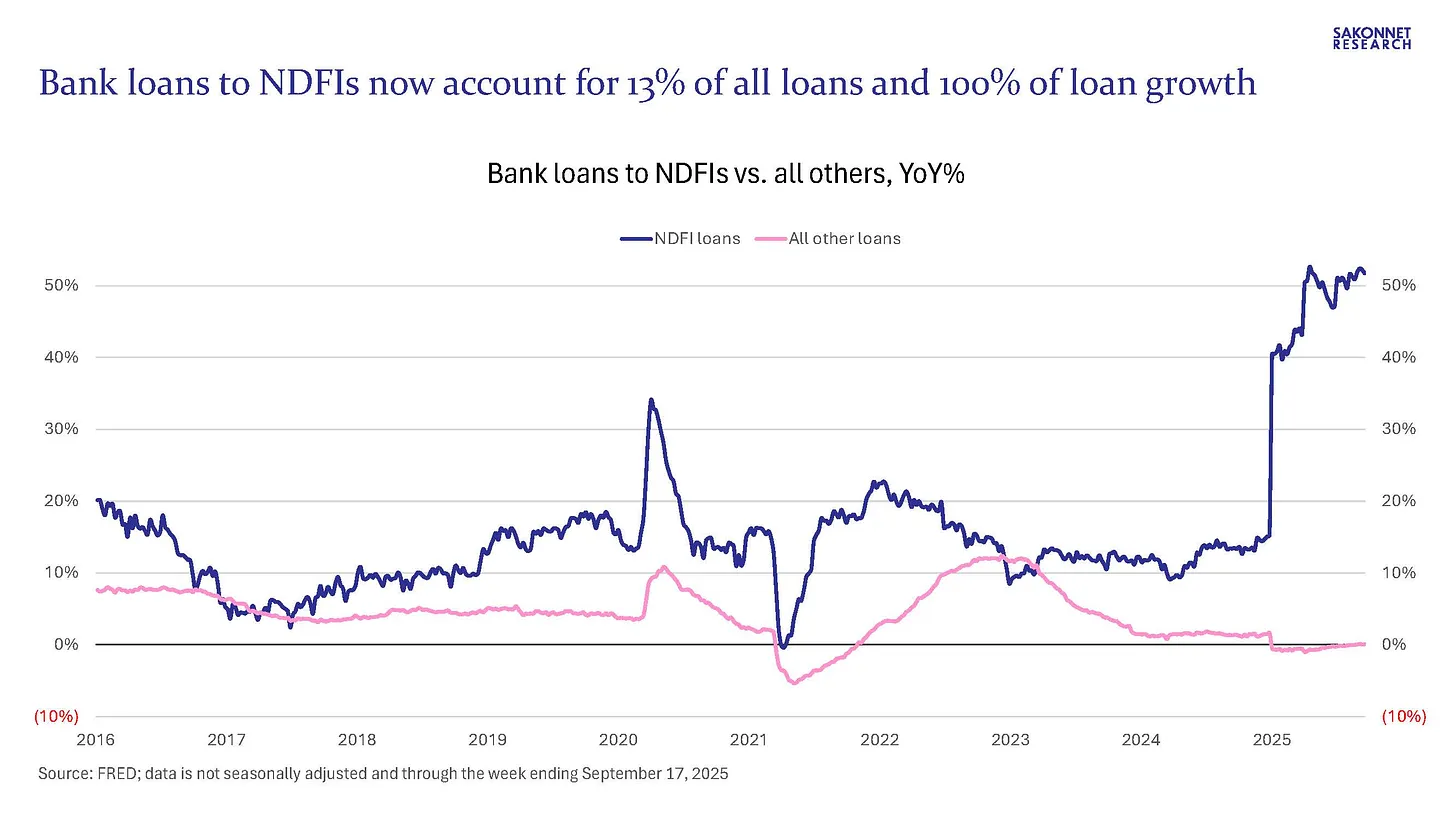

NDFI Loans Are Far Larger Than We Thought

09/27/25

I’ve written extensively about mushrooming bank lending to nondepository financial institutions (NDFIs) such as broker-dealers, hedge funds, private equity and credit funds, securitization vehicles and subprime auto lenders. Such lending to the financial sector has helped fuel record-high…

-

Financial System Leverage At Record Highs in Many Cases

09/19/25

I published my last update on the numerous types of leverage/debt that have built up in the financial system (and inflated asset prices) a month ago; it’s time for another. Leverage keeps going up, up, and up, which continues to inflate asset prices.

-

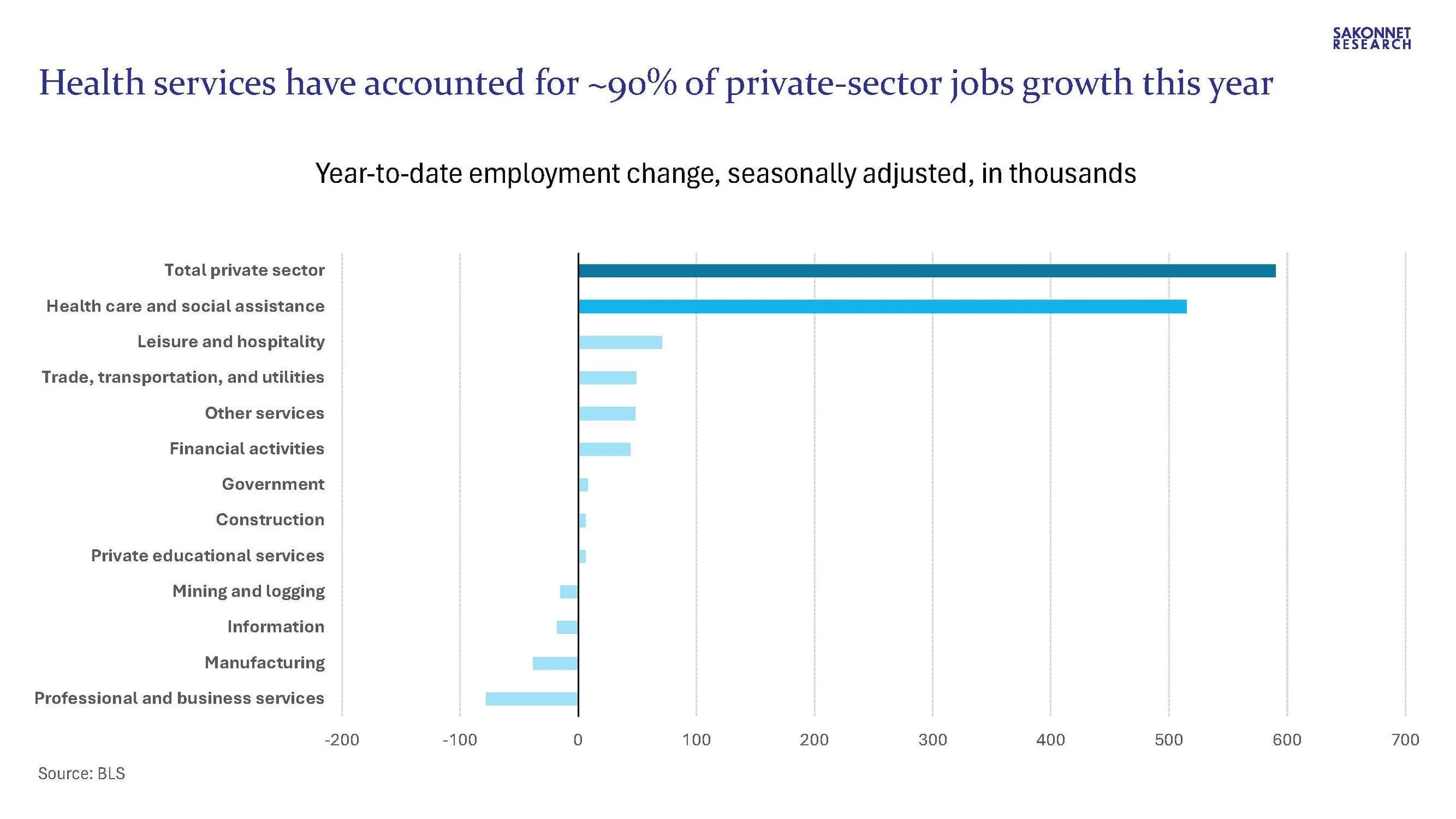

The Coming Pain for Consumer Companies

09/09/25

I’ve written at length about the prolonged weakness in U.S. goods demand; the “freight recession” that began in early 2022 shows no signs of abating. Services demand has recently faltered as well, with the two largest U.S. hotel chains reporting their weakest domestic…

MEDIA APPEARANCES

-

What we do in the (banking) shadows

9/30/25

By Robert Armstrong -

Trump’s tariffs are driving a wedge through the US economy, further separating the haves from the have-nots

9/26/25

By Alicia Wallace -

Cardboard-Box Demand Is Slumping. Why That’s Bad News for the Economy.

9/21/25

By Ryan Dezember -

What Declining Cardboard Box Sales Tell Us About the US Economy

8/14/25

By Ilena Peng